Practice Areas

Who is Victimized by Identity Theft?

What Companies Have Been Ravaged by Identity Theft?

Stanley and Armelia Oliver v. MBNA America Bank, N.A., GE Money Bank f/k/a Monogram Credit Card Bank of GA; Chase Bank USA, N.A. f/k/a First USA Bank, N.A., Capital One, HSBC Card Services, Inc., f/k/a Household Credit Services, Inc.,, Cardholder Management Systems, American Express, Pentagroup Financial, LLC, Holloway Credit Solutions, LLC, Briggitte Simpson, Asset Acceptance, LLC, wholly owned subsidiary of AA Capital Corp.,, Advantage Assets, Inc., LTD Financial Services, Academy Collection Service, Inc., Merchants Credit Guide Co., Nextel Partners Operating Corp., First Revenue Assurance, LLC, AFNI, Inc., American Collection Enterprise, Inc., United Recovery Systems, Inc., Nationwide Credit, Inc.

What Types of Cases Do We Represent?

- Fraud

- Slander

- Defamation

- Negligence

- Wantonness

- Conversion

- Unjust Enrichment

- Intentional Infliction of Emotional Distress

- Harassment

Result: Pending Litigation

Venue: Dallas County, Alabama

What Happens When A Relative Steals Your Identity?

Stanley and Armelia Oliver live in Selma, Alabama. A relative of the Oliver’s used their personal information to fraudulently obtain credit cards and open up various accounts. When the Olivers’ discovered this to be the case, they reported it to law enforcement. The relative was arrested, plead guilty, and is currently under a restitution order.

Mr. and Mrs. Oliver notified the various creditors, collection companies and credit reporting agencies that they were victims of identity theft. Despite this notification, a number of creditors and/or their collection agencies continued to harass the plaintiffs with calls and letters to their home and places of employment. The plaintiffs even hired an attorney to write letters to various creditors and collection agencies. Even this did not stop some creditors and collection agencies from continuing to harass the plaintiffs.

The plaintiffs hired Pittman, Dutton, Hellums, Bradley & Mann, P.C. who have sued the defendants for Fraud, Slander, Defamation, Negligence, Wantonness, Conversion, Unjust Enrichment, Intentional Infliction of Emotional Distress and Harassment.

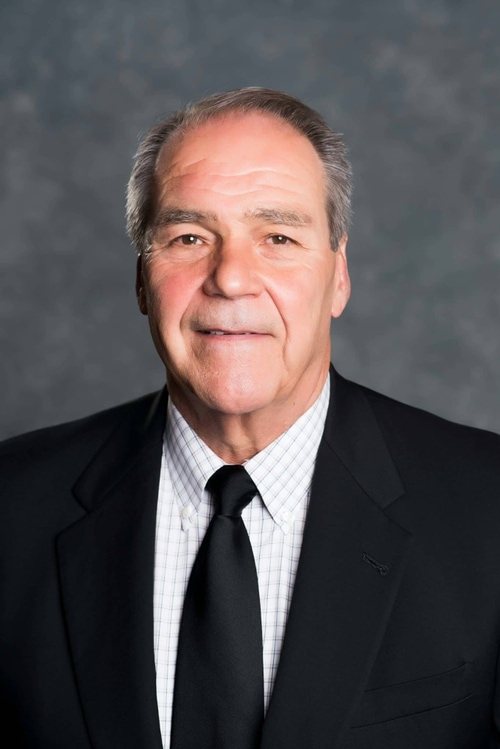

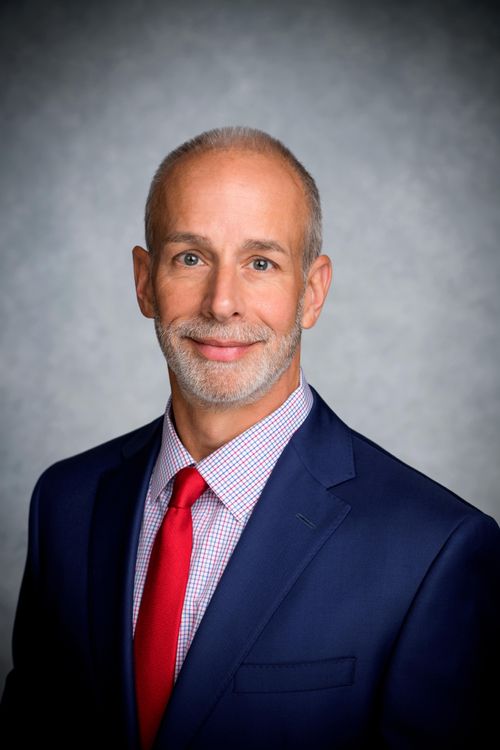

This case is being handled by Chris T. Hellums.

What Happens When a Victim of Identity Theft Is Sued by a Creditor?

Asset Acceptance, L.L.C., as Assignee of Chase Manhattan Bank (USA), as Assignee of Providian National Bank v. Merle Minor

Type of Case: Malicious Prosecution/Negligence/Wantonness/Slander/

Defamation Result: Pending Litigation

Venue: Tuscaloosa County, Alabama

Mrs. Minor never applied for or opened an account with credit card company or Asset Acceptance, L.L.C. However, in the Fall of 2003, Asset Acceptance filed suit against Mrs. Minor alleging that she owed money on an account which was fraudulent opened.

Mrs. Minor was forced to hire an attorney to defend her in that case. Throughout the entire case, Mrs. Minor proclaimed that she was a victim of identity theft. Asset Acceptance ultimately dismissed that case.

To Mrs. Minor’s shock, some three years later, Asset Acceptance renewed collection efforts and again filed suit over the same account debt.

In response, the plaintiff hired Pittman, Dutton, Hellums, Bradley & Mann, P.C., who have countersued Asset Acceptance, L.L.C. for Malicious Prosecution, Negligence, Wantonness, Slander and Defamation.